Save Tax on Fixed Deposits

Business owners often operate in unpredictable environments, with income fluctuating and sometimes even facing losses during downturns. To mitigate these risks, many choose to set aside a portion of their earnings in long-term Fixed Deposits (FDs), seen as safe, reliable investments offering fixed returns. However, the interest earned on FDs is taxable, which can significantly reduce the effective return, particularly for those in higher tax brackets. But did you know there’s a way to defer this tax and enhance your returns? Let’s explore how deferring taxes can help you save money.

The Concept of Tax Deferral

Tax deferral is a strategy where you delay paying taxes on your earnings until a later date, allowing your money to grow tax-free in the meantime. This maximizes the benefits of compounding and can significantly increase your overall returns. Let’s dive into how you can defer taxes on income earned from Fixed Deposits by using an alternative investment strategy—Debt Mutual Funds.

What Are Debt Mutual Funds?

Debt mutual funds invest in fixed-income instruments like Non-Convertible Debentures (NCDs), government securities, and corporate bonds. They offer a diversification advantage, spreading your exposure across multiple institutions, unlike bank FDs which tie your investment to a single bank.

How Taxation Differs Between FDs and Debt Mutual Funds

- Interest Booking in FDs: In India, the interest earned on FDs is added to your income and taxed according to your income tax slab. For example, if you invest ₹10,00,000 in an FD with a 7% return, the entire ₹70,000 is considered income and taxed. After tax, your effective return might drop to around 4.9%, barely keeping up with inflation, let alone growing your wealth.

- Income Booking in Debt Mutual Funds: In contrast, with debt mutual funds, your principal grows with the increase in Net Asset Value (NAV). When you withdraw ₹70,000, you sell a portion of your units at the current NAV, and tax is only calculated on the profit portion (i.e., the difference between the current NAV and the purchase NAV). This significantly reduces your tax liability.

A Practical Example: FD vs. Debt Mutual Funds

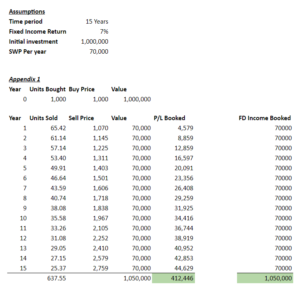

Over a 15-year period with a fixed income return of 7%, We will withdraw ₹1.05 crores in both FDs and Debt Mutual Funds. But the profit booked from Debt Mutual Funds will be 60% lower than that from FDs. Lower profits mean lower taxes. The remaining profits in Debt Mutual Funds are reinvested, with your initial capital intact, continuing to generate returns.

Benefit of Deferring Taxes

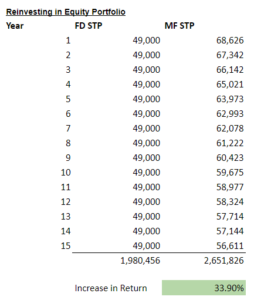

- Higher Reinvestment Amount: With 60% of profits deferred, only the principal is withdrawn, allowing us to reinvest significantly higher amounts compared to Bank FDs. This difference can significantly enhance returns. If we reinvest in a conservative equity mutual fund portfolio, we can potentially generate over 33% of more returns.

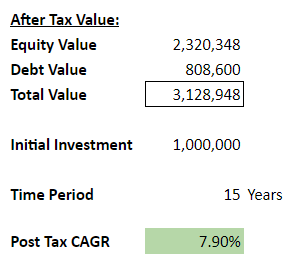

- Secure Equity Portfolio: By doing a Systematic Investment Plan (SIP) with the interest income earned, you can achieve a decent equity return without risking your initial capital. This strategy can cumulatively provide a risk-free post-tax return of around 8%.

Conclusion

Deferring tax on income earned from Fixed Deposits by switching to debt mutual funds can be a highly effective way to maximize post-tax returns. By understanding the tax implications and leveraging strategic investments, you can significantly increase the wealth accumulated over time.

If you’re interested in exploring this strategy further and seeing how it fits into your overall financial plan, feel free to reach out to us. We can provide tailored advice based on your individual needs and goals.

Try our retirement calculator: Retirement Calculator

Check out more free resources: Our Insights

Interested in our services: Contact Us