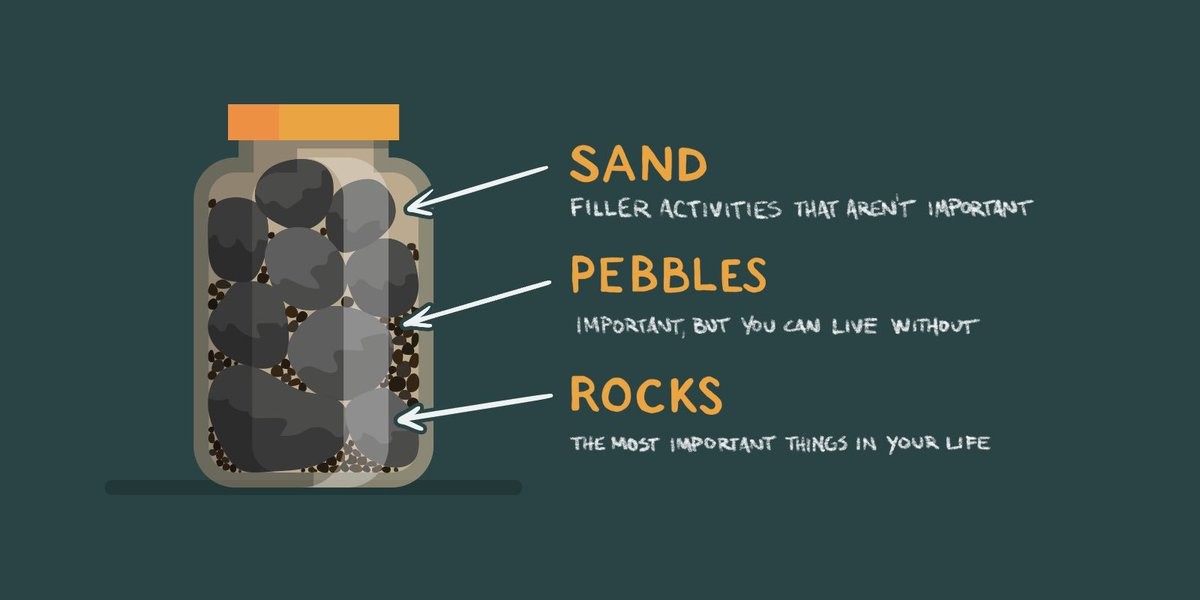

Investment Insights from the Rocks, Pebbles, and Sand Story

Have you ever come across the story of the professor who used a jar filled with rocks, pebbles, and sand to illustrate an important life lesson? It’s a simple yet powerful analogy that teaches us about priorities. But did you know this concept can also be applied to personal finance and investment strategies?

Let’s explore how this analogy can help you build a balanced and effective investment portfolio.

The Rocks: Your Core Investments

In the story, the rocks are the largest items in the jar, representing the most important aspects of life—like family, health, and relationships. In the context of investments, the “rocks” are your core investments, the foundation of your financial portfolio. These are assets that should be stable, reliable, and integral to your long-term financial success.

- Examples of Rocks: Blue-chip stocks, real estate, retirement funds, and government bonds. These investments are typically lower-risk, providing steady growth and income over time. They are the bedrock upon which you build your wealth, ensuring financial security for the future.

The Pebbles: Your Secondary Investments

Pebbles are smaller than rocks but still significant. They represent the moderately important aspects of life—things like your job, house, or hobbies. In your investment portfolio, pebbles are the secondary investments that add value but aren’t as critical as the rocks.

- Examples of Pebbles: Mid-cap stocks, diversified mutual funds, corporate bonds, and perhaps some balanced funds. These investments carry a bit more risk but offer the potential for higher returns. They complement your core investments by diversifying your portfolio and helping to accelerate your wealth-building efforts.

The Sand: Your Minor Investments

Finally, the sand represents the small, seemingly insignificant things in life—daily chores, minor tasks, or trivial matters. In investing, the sand symbolizes the minor, more speculative investments that should only come into play after you’ve taken care of the rocks and pebbles.

- Examples of Sand: Short-term stocks, small speculative bets, cryptocurrency, or penny stocks. These investments are high-risk and should only make up a small portion of your portfolio. They have the potential for quick gains but also the risk of significant losses. If you focus too much on these “sands,” you might crowd out the more important, stable investments.

The Lesson: Prioritizing Your Investments

The key takeaway from the rocks, pebbles, and sand story is prioritization. Just like in the story, if you fill your jar with sand first, there won’t be enough room for the rocks. Similarly, if you focus on speculative, minor investments first, you might crowd out the critical, stable investments that are essential for long-term success.

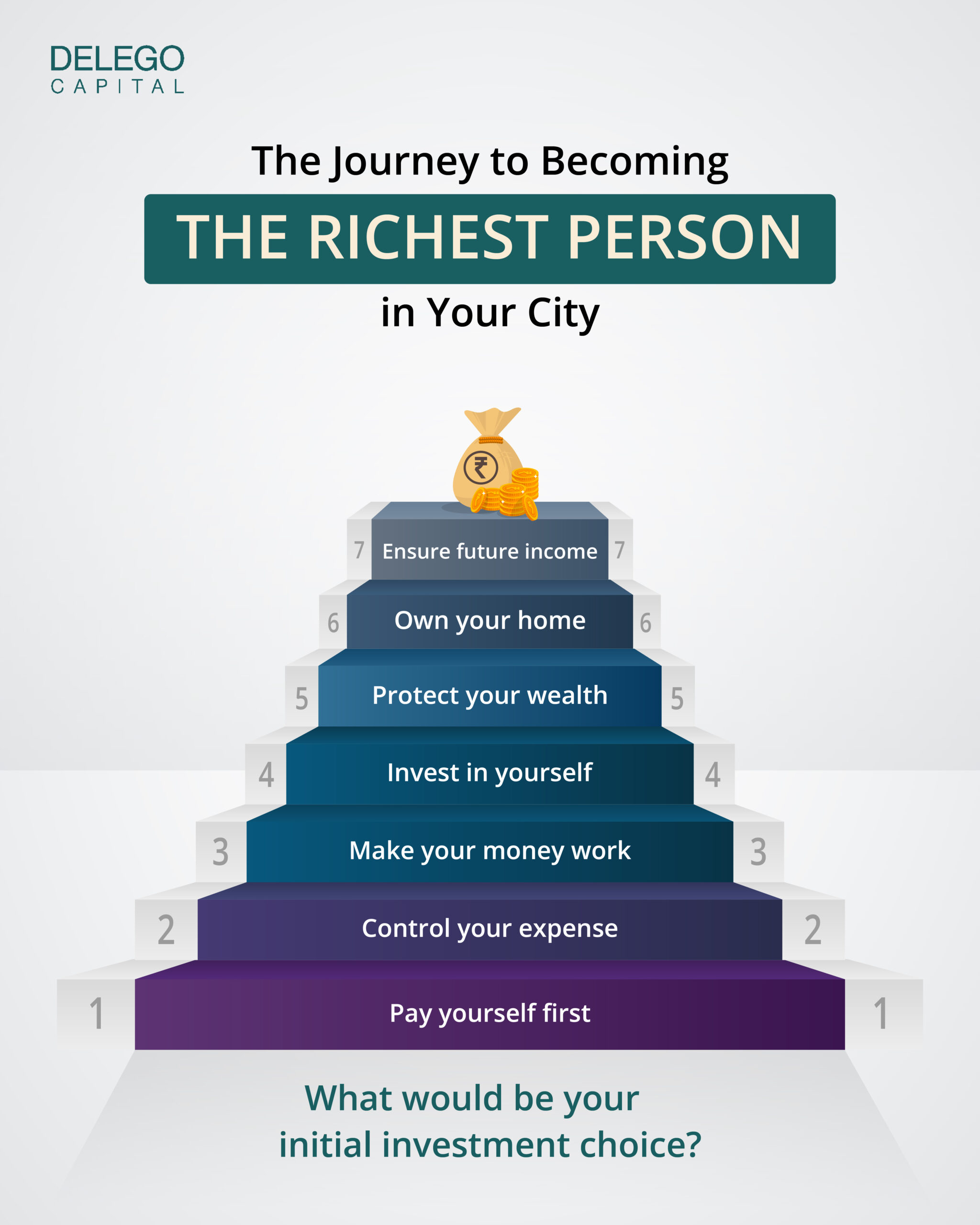

Start with the Rocks: Ensure your financial portfolio prioritizes the essential “rocks” first—these are your core investments that provide a strong foundation for your financial future.

Add the Pebbles: Once the rocks are in place, introduce the pebbles. These secondary investments will add significant value and help diversify your portfolio.

Finish with the Sand: Only after your rocks and pebbles are securely in place should you consider adding the sand—those smaller, riskier investments that can offer quick gains but come with higher risk.

Building a Balanced Portfolio

In personal finance, balance is key. A well-structured portfolio is like a well-filled jar: the big, important investments are given priority, followed by supplementary ones that add value, and finally, the speculative ones that should only be considered if there’s room.

By applying the rocks, pebbles, and sand analogy to your investment strategy, you can ensure that your financial priorities are in order, leading to a more secure and prosperous financial future.

Try our retirement calculator: Retirement Calculator

Check out more free resources: Our Insights

Interested in our services: Contact Us