Becoming the Richest Person in Your City

The Journey to Becoming the Richest Person in Your City: A Modern Approach Inspired by Timeless Wisdom

In the pursuit of wealth, many of us find ourselves navigating a complex financial landscape, often unsure of where to begin. But what if the principles that could guide us toward financial success have been around for centuries? Inspired by the timeless lessons from George S. Clason’s The Richest Man in Babylon and modern strategies tailored to today’s financial realities, this blog post will explore how you can embark on your journey to becoming the richest person in your city.

The Foundation: Timeless Wisdom for Building Wealth

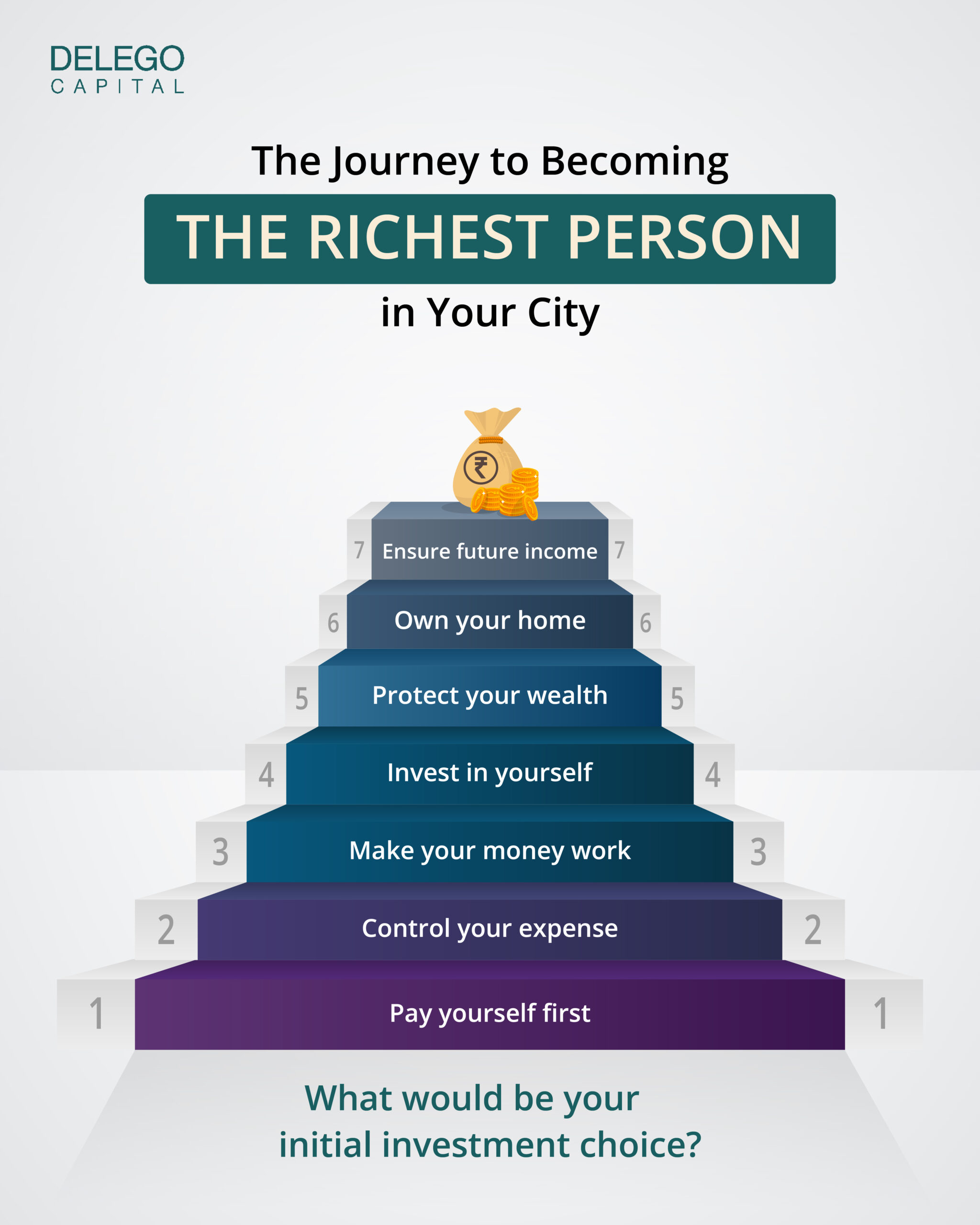

The first step to becoming wealthy is to understand the fundamental principles of money management. These principles, though simple, have stood the test of time and remain as relevant today as they were when Clason first introduced them in his classic book.

- Pay Yourself First: This principle emphasizes the importance of saving a portion of your income before paying any expenses. Clason recommends saving at least 10% of your earnings. This money becomes the seed from which your tree of wealth will grow. By consistently setting aside a portion of your income, you create a habit of saving that becomes the cornerstone of your financial success.

- Control Your Expenditures: It’s easy to fall into the trap of spending more as you earn more, but Clason warns against this lifestyle inflation. Instead, focus on eliminating unnecessary expenses. By keeping your spending in check, you can maximize your savings and direct more money toward investments that will grow your wealth.

- Make Your Money Work for You: Simply saving money isn’t enough. To truly build wealth, you need to invest your savings in opportunities that generate additional income. Whether through stocks, mutual funds, real estate, or other investment vehicles, the goal is to make your money work for you, so it grows over time.

Modern Investment Strategies to Grow Your Wealth

Building on these foundational principles, modern financial strategies offer a wide array of investment options that can help you grow your wealth. Here are some to consider:

- Invest in Yourself: One of the most valuable investments you can make is in your own skills and knowledge. Whether through formal education, online courses, or professional development, enhancing your abilities can lead to higher earning potential and better financial decisions. For business owners, this might also mean investing in assets that boost productivity and profitability.

- Protect Your Wealth with Fixed Deposits and Gold: Before diving into more complex investments, it’s crucial to have a safety net. Start with Fixed Deposits (FDs) to ensure you have at least six months of expenses saved. This provides financial security in case of emergencies. Additionally, consider investing in gold as a hedge against inflation and economic uncertainty.

- Diversify Your Investments: Once you have a solid foundation, it’s time to diversify. Consider a mix of debt and equity mutual funds, which offer a balance between risk and return. Public equities, government and corporate bonds, and theme-based funds like REITs/InvITs (Real Estate Investment Trusts/Infrastructure Investment Trusts) are excellent options for building a diversified portfolio.

- Explore Alternative Investments: For those looking to expand their portfolio further, alternative investments such as AIFs (Alternative Investment Funds) and private equity can offer higher returns, albeit with higher risks. These investments are typically less liquid and require a longer investment horizon, but they can be a valuable part of a wealth-building strategy.

Addressing the Pain Points of Wealth Management

As you embark on this journey, it’s important to recognize and address the common challenges that many face when managing their wealth. One significant pain point is the inability to access liquidity from assets due to poor financial management. This often leads to distress sales at a loss, which can severely impact your wealth.

To avoid this, it’s crucial to have a well-planned strategy that includes maintaining an adequate emergency fund, diversifying investments, and having a clear understanding of your financial goals. By doing so, you can ensure that you have the liquidity needed to weather financial storms without resorting to selling assets at a loss.

Achieving Financial Independence and Securing Your Future

The ultimate goal of wealth building is to achieve financial independence—a state where your investments generate enough income to cover your living expenses, allowing you to live comfortably without relying on a paycheck. This requires a disciplined approach to saving, investing, and managing your finances.

- Create a Reliable Financial Safety Net: As you grow your wealth, it’s essential to separate your personal wealth from your business assets. This ensures that your family’s financial future is secure, even if your business faces challenges. A well-structured financial plan, including insurance and estate planning, can provide the safety net you need.

- Leverage Expertise in Equity Investment and Risk Management: Navigating the financial markets can be complex, but with the right expertise in equity investment and risk management, you can maximize your returns while minimizing risks. Consider working with a financial advisor who can guide you through the intricacies of investment strategies and help you achieve your financial goals.

- Continuously Reinvest Your Earnings: One of the keys to building wealth is to reinvest the income generated from your investments. This allows your wealth to compound over time, accelerating your journey to financial independence. Whether it’s reinvesting dividends from stocks or profits from real estate, the more you reinvest, the faster your wealth will grow.

Conclusion: The Journey to Financial Success

Becoming the richest person in your city isn’t just about accumulating wealth—it’s about building a solid financial foundation that allows you to grow and protect your wealth over time. By following the timeless principles of paying yourself first, controlling your expenditures, and making your money work for you, combined with modern investment strategies, you can set yourself on the path to financial success.

Remember, the journey to wealth is a marathon, not a sprint. It requires patience, discipline, and a long-term perspective. But with the right approach, you can achieve financial independence and secure a prosperous future for yourself and your family.

Try our retirement calculator: Retirement Calculator

Check out more free resources: Our Insights

Interested in our services: Contact Us